China’s Cotton Yarn Imports In September Down 58.9% On Year

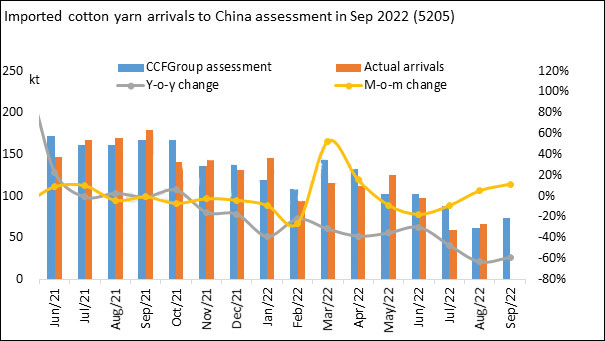

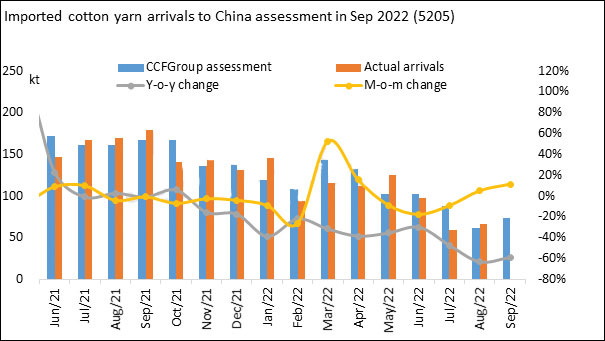

Cotton yarn imports of China are forecast at 73.7kt in September, down about 58.9% on year and up 11.33% on month.

China’s cotton yarn imports have shown a step-like decline since March this year, and cotton yarn imports shrank sharply mainly due to the lack of domestic demand and ordering chance. Until the first half of July, spot market ushered restocking chance at low level after prices of ICE cotton futures fell back, and cotton yarn imports rose again since August. According to CCFGroup’s survey, cotton yarn imports will arrive intensively in the first half of September. The preliminary assessment of cotton yarn imports will reach 73.7Kt in September, down 58.9% on year and up about 11.33% on month with the increase of more than 8Kt.

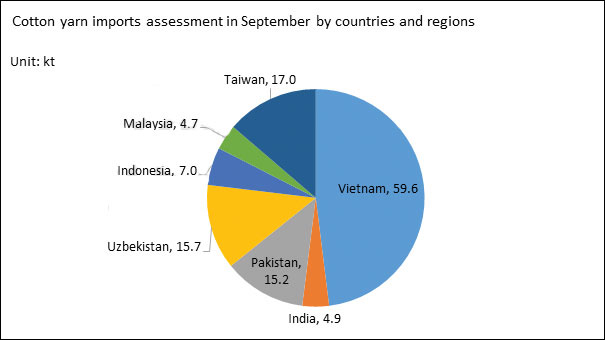

According to export data released by Vietnamese Customs, 50% of Vietnam’s cotton yarn exports were to China, which could go up to 60% by the year end. Indian yarn prices are not profitable, and Chinese mills looked elsewhere for their yarn requirements. Also, the previous ordered Uzbekistani yarn was at great losses, making more traders turn to procure Vietnamese yarn.

According to export data released by Vietnamese Customs, 50% of Vietnam’s cotton yarn exports were to China, which could go up to 60% by the year end. Indian yarn prices are not profitable, and Chinese mills looked elsewhere for their yarn requirements. Also, the previous ordered Uzbekistani yarn was at great losses, making more traders turn to procure Vietnamese yarn.

Pakistani yarn exports increased on month according to data released by customs in August, and seasonal restocking of that in China increased obviously. However, Pakistani siro-spun hasn’t arrived at port on time in September due to the delay of shipment after Pakistani flood, so the imports will be at peak in late-October. Some Uzbekistani yarn mills reduced the production of ring-spun yarn as previous cotton prices were too high. In September, low-count Uzbekistani ring-spun yarn imports will also keep at low level.

Pakistani yarn exports increased on month according to data released by customs in August, and seasonal restocking of that in China increased obviously. However, Pakistani siro-spun hasn’t arrived at port on time in September due to the delay of shipment after Pakistani flood, so the imports will be at peak in late-October. Some Uzbekistani yarn mills reduced the production of ring-spun yarn as previous cotton prices were too high. In September, low-count Uzbekistani ring-spun yarn imports will also keep at low level.

| Month | Vietnamese yarn exported to China (Kt) | Overall export of Vietnamese yarn (Kt) | Proportion |

| Jan | 63.6 | 134.2 | 47% |

| Feb | 63.6 | 122.7 | 52% |

| Mar | 80.5 | 151.8 | 53% |

| Apr | 73.1 | 135.3 | 54% |

| May | 62.1 | 124.9 | 50% |

| June | 47.9 | 117.9 | 41% |

| Jul | 45.9 | 101.2 | 45% |

| Aug | 57.5 | 115.3 | 50% |

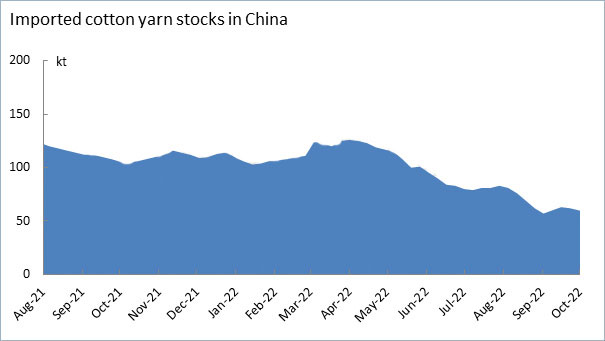

Secondly, domestic stocking of some varieties such as low-count open-end yarn was obviously insufficient as the usage for that was large recently, and product allocation was more difficult.

Thirdly, Chinese market couldn’t accept buying Indian cotton prices with high prices, making Indian combed yarn basically out of stock. Now the price spread between forward imported yarn prices and domestic one has gradually recovered. However, the profit of traders are hard to ensure. In short term, imported yarn will still mostly focus on destocking slowly.

Secondly, domestic stocking of some varieties such as low-count open-end yarn was obviously insufficient as the usage for that was large recently, and product allocation was more difficult.

Thirdly, Chinese market couldn’t accept buying Indian cotton prices with high prices, making Indian combed yarn basically out of stock. Now the price spread between forward imported yarn prices and domestic one has gradually recovered. However, the profit of traders are hard to ensure. In short term, imported yarn will still mostly focus on destocking slowly.

Conclusion

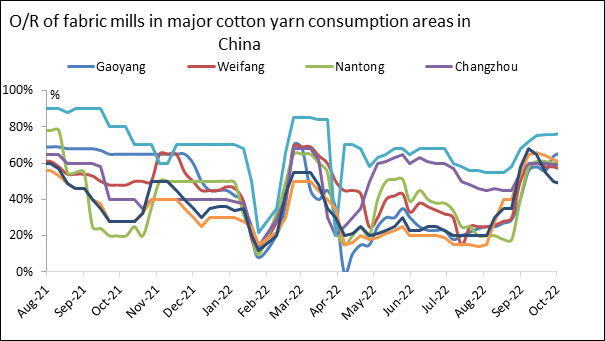

Cotton yarn imports have slipped obviously since this year. Amid slack sales and losses for a long time, traders in spot imported yarn market had to reduce the stocking of imported cotton yarn to fit into continuous adjustment of supply and demand situation in China. At present, cotton yarn imports this year is assessed at 1,100Kt, down from 1300Kt. In the future, imported cotton yarn still has chance with continuous falling back of Indian cotton and ICE cotton futures prices. Forward yarn mills may turn over the long-term loss condition, and gradually improve the operating rate. Meanwhile, the compress of cost may recover the profit of imported cotton yarn.

Conclusion

Cotton yarn imports have slipped obviously since this year. Amid slack sales and losses for a long time, traders in spot imported yarn market had to reduce the stocking of imported cotton yarn to fit into continuous adjustment of supply and demand situation in China. At present, cotton yarn imports this year is assessed at 1,100Kt, down from 1300Kt. In the future, imported cotton yarn still has chance with continuous falling back of Indian cotton and ICE cotton futures prices. Forward yarn mills may turn over the long-term loss condition, and gradually improve the operating rate. Meanwhile, the compress of cost may recover the profit of imported cotton yarn.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.