Turkey Gains From US T&C Supply Chain Shift

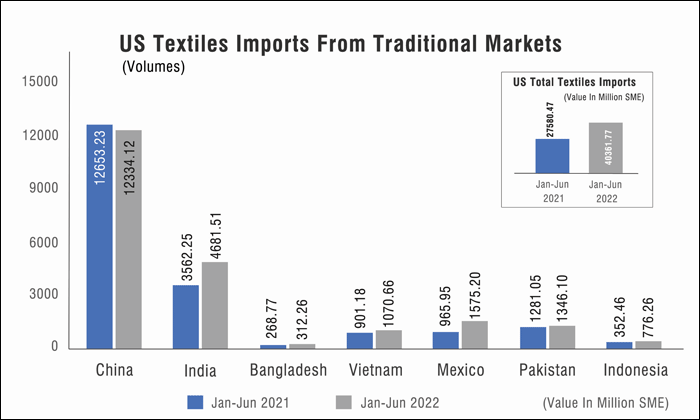

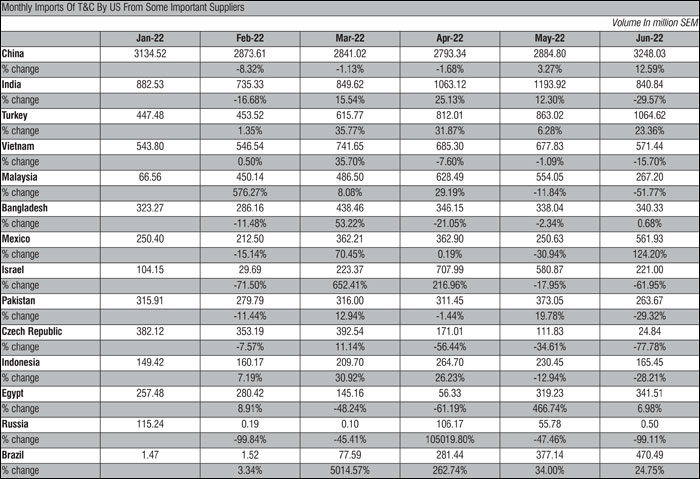

There are some interesting trends in US textile imports, as per the statistics from OTEXA.

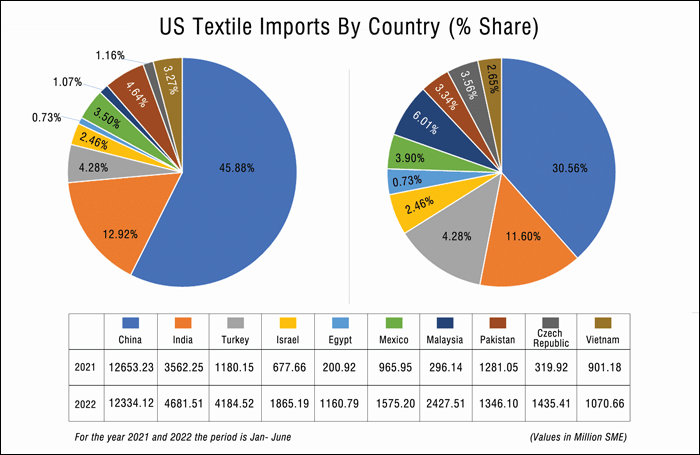

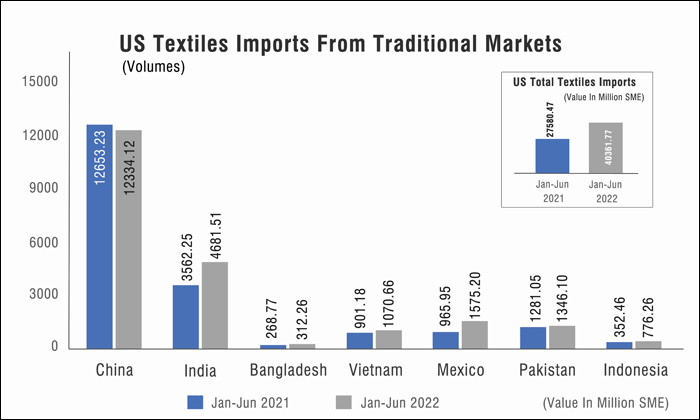

Once again, China remains the top supplier of textiles to the US market, accounting for a share of 30.56% in US imports from Jan-June 2022. However, this share has fallen from 45.88% in CPLY. Also, among the top 10 suppliers, China is the only one whose exports of textiles to the US fell by 2.52%.

India, the second largest supplier accounts for 11.60% share of total US textile imports, a slight fall in share from 12.92% in Jan-June 2021. US textile imports from India were up 31.42% during the period. The top 10 suppliers of textiles to the US market account for 79.48% share of total US textile imports.

India, the second largest supplier accounts for 11.60% share of total US textile imports, a slight fall in share from 12.92% in Jan-June 2021. US textile imports from India were up 31.42% during the period. The top 10 suppliers of textiles to the US market account for 79.48% share of total US textile imports.

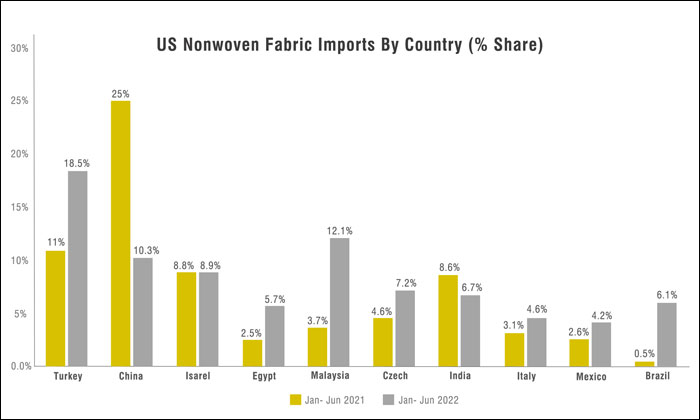

US nonwoven imports on the rise

US imports of nonwoven fabrics and products went up by 194.61% in the first six months of 2022. Turkey was the top supplier. Turkey's exports in this segment went up by 395.77%, and the share went up to 18.5% from 11%.

US nonwoven imports on the rise

US imports of nonwoven fabrics and products went up by 194.61% in the first six months of 2022. Turkey was the top supplier. Turkey's exports in this segment went up by 395.77%, and the share went up to 18.5% from 11%.

China was the second largest supplier, but its share went down to 10.28%. There is clearly huge demand for technical textiles and nonwovens in the US market, and India needs to do more than just term this sector as the sunshine industry. This is particularly in light of the fact that countries like Egypt and Malaysia have significantly increased their shares in this product basket to the US.

China was the second largest supplier, but its share went down to 10.28%. There is clearly huge demand for technical textiles and nonwovens in the US market, and India needs to do more than just term this sector as the sunshine industry. This is particularly in light of the fact that countries like Egypt and Malaysia have significantly increased their shares in this product basket to the US.

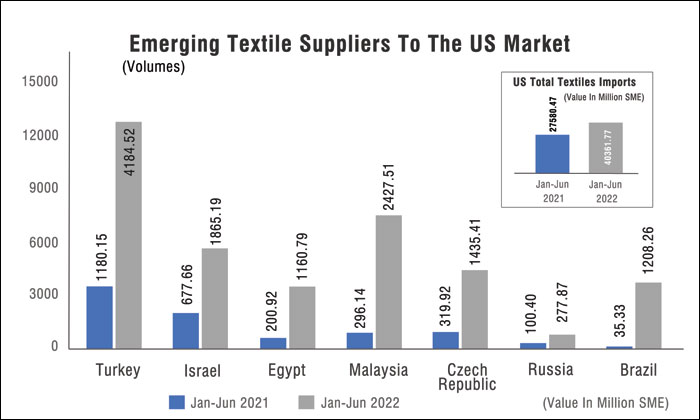

Turkey becomes an important supplier of textiles to the US

Turkey has become an important supplier of textiles and apparel to the world market. It is one of the clear beneficiaries of the supply chain move away from China. And Turkish textile industry is benefitting from the Russia-Ukriane war too, by becoming an important supplier to Russian market, at a time when most western brands have exited. US textile imports from Turkey went up by 254.58% during Jan-June 2022. And its share in the US textile import basket climbed up from 4.28% to 10.37% in the period under review. US imports from Turkey have been almost consistently rising from the beginning of 2022, except in the month of May when imports from Turkey were down by almost 36%. This was the month when the impact of the Russia-Ukraine war became severe, and supply chains were in a state of flux. In the first half of 2022, Turkey's exports of textiles and clothing to the US went up by 244.24% to 4256.422 SME. Almost all of this increase happened due to a spurt in US imports of MMF-based fabrics from Turkey, mainly comprising nonwoven fabrics. Nonwoven fabrics accounted for over 87% of total US textile imports from Turkey.

Israel

Another surprising textile supplier to the US is Israel. US imports went up by 174.42% from Israel, and its share, albeit meagre has gone up to 3.28% from 1.66% earlier. US imports of textiles from Israel have gone up by 175.24% in the first six months of 2022 Almost the entire exports of T&C from Israel - 94.42% - are constituted by nonwoven fabrics.

Egypt

Egypt's exports of textiles too have shown a tremendous jump of 477.75% during the first half of 2022. The country accounts for 2.88% share in the US textile import basket. Egypt's export basket for the US market has undergone a remarkable change in the first six months of 2022. Egypt’s exports of T&C to the US increased by as much as 273.91%, propelling its share to 2.46% from just 0.91% earlier.

Apparel, which had constituted 46% of the export basket, now has just 17% share in total US imports of T&C from Egypt. And textiles, which had a share of around 54%, went up to 83% in the first six months of this year. And its textile exports are almost entirely made up of MMF fabrics - 99.73%. And nonwovens make up the entirety of the fabrics exports of Egypt - 97% of total fabrics are nonwoven fabrics. This was 83% earlier.

Also surprisingly, Egypt's cotton product exports, though increasing by 35%, have come down to just 4.32% of the share in the basket. This is surprising given that Egyptian cotton is much demanded the world over. Clearly, the shift is towards MMF.

Malaysia

Malaysia's exports to the US went up by as much as 671.26%. While apparel imports went up by 16%, non-apparel imports were up 719.73%. Nonwoven fabrics accounted for 98% of total textile exports of Malaysia to the US, accounting for a 875.45% increase in exports. Malaysia's share in US T&C exports, was a meagre 0.78%, which in Jan-June 2022 has gone up to 4.31%.

Czech Republic

US imports from Czech Republic went up by 348.49%, almost entirely due to huge increase in imports of MMF based nonwoven fabrics. Imports of nonwoven fabrics rose 362.19% during Jan-June 2022. Due to this, the country's share in US total T&C imports went up to 2.52%, from 0.78% earlier.

Russia

A similar trend is seen in US imports from Russia! US imports from Russia during the first six months of 2022 increased 176.61%, again almost completely driven by imports of MMF based nonwoven fabrics. Imports were high in January, April and May.

Brazil

And the trend remains the same for Brazil too. US imports from Brazil went up by 3207.66%, taking the country's share to 2.12%, from 0.09% earlier. And almost 100% of the imports were driven by MMF based nonwoven fabrics and products. Imports from Brazil showed a positive strong trend in every month from Jan-June. As against this, imports from the regular suppliers fluctuated during the months.

There are some interesting trends in US textile imports, as per the statistics from OTEXA. Once again, China remains the top supplier of textiles to the US market, accounting for a share of 30.56% in US imports from Jan-June 2022. However, this share has fallen from 45.88% in CPLY

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.