Pakistan’s Constrained Supplies Drive 2022/23 Consumption Lower

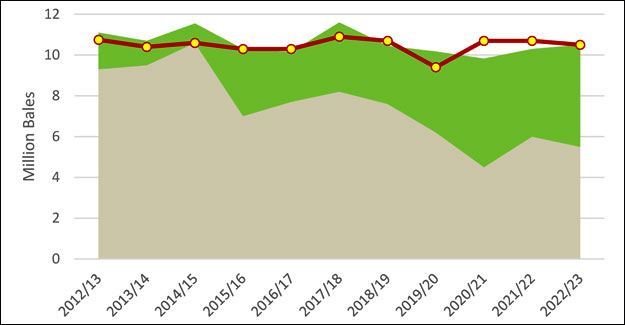

Pakistan’s 2022/23 consumption is forecast down 400,000 bales to 10.5 million this month pressured by a smaller crop. Domestic production is forecast down 700,000 bales to 5.5 million, the second lowest production level in nearly 40 years and attributed to recent floods and heatwaves. Smaller-sized mills are particularly reliant on domestic supplies and unable to fully substitute with imports.

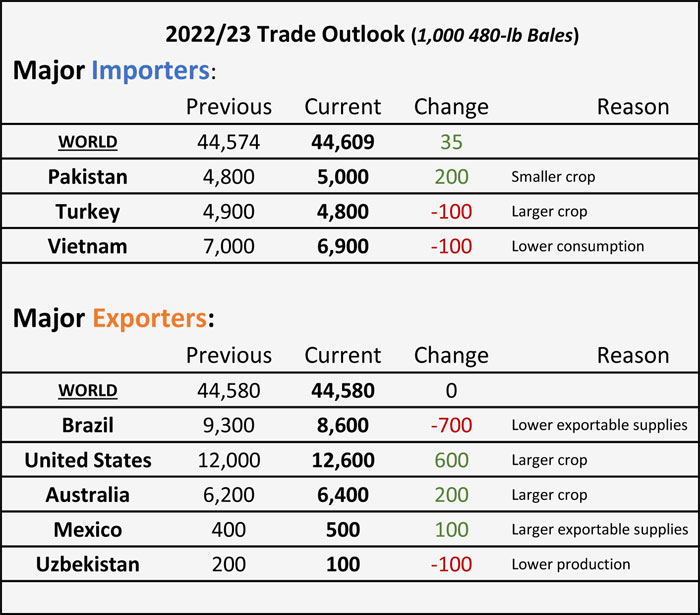

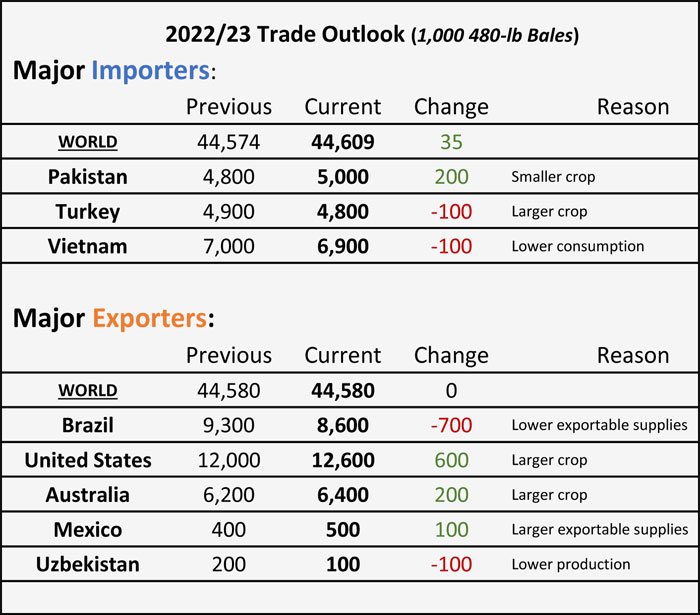

Imports are now projected at their second highest level to 5.0 million bales, up from last month’s projection of 4.8 million. With a significant production decline in the United States, its largest supplier, the All Pakistan Textile Mills Association is reported to have asked government officials to consider lifting the country’s restriction on imports of Indian cotton. The country restricted Indian cotton in 2019 due to border disputes and this urgent request underscores Pakistan’s dire need for cotton.

Falling consumption is also attributed to nationwide energy shortages and higher electricity prices as heatwaves are straining local power grids. Higher costs lower mills’ profit margins, particularly for denim manufacturers. Pakistan’s processed denim products account for a significant portion of exports, especially to the world’s two largest cotton apparel importers, the United States and Europe.

Pakistan’s textile industry is the largest manufacturing sector according to the country’s Ministry of Commerce, with cotton yarn, fabrics, and other value-added cotton textile products accounting for a significant portion of the country’s gross domestic product. Cotton and textile products contribute roughly 60% of the country’s exports per annum according to a recent report from the country’s Textile Commissioner’s Organization.

Lower domestic supplies and issues with electricity availability are expected to pressure consumption and potentially curb future textile exports.

2022/23 Outlook

Global production is up 1.4 million bales at 118.4 million, and stocks are projected higher this month and unchanged from the previous year. Consumption is down slightly to 118.6 million bales with lower projected use in Pakistan and Vietnam. Global trade is unchanged as higher US exports more than offset lower Brazil shipments.

The US balance sheet shows higher beginning stocks, production, exports, and ending stocks.

Production is raised 1.3 million bales with larger prospects for most major producing states compared with last month. The projected US season-average farm price is forecast down 1 cent to 96 cents per pound.

Global cotton prices

Global cotton prices were mixed following last month’s WASDE. Both the A-Index and US price were mostly unchanged despite a significantly lower projected US crop in last month’s report. Prices on the Intercontinental Exchange (ICE) surged to more than 115 cents per pound before falling back to levels around 100 cents.

Prospects for higher US interest rates pressured US commodity index funds with the Bloomberg Spot Commodity Index lower than last month. China prices continued to decline and reflect burgeoning commercial stocks in the Xinjiang province before the onset of harvest. Prices in India fell more precipitously relative to other origins as the Securities and Exchange Board of India (SEBI) temporarily suspended trading of 2023 cotton futures on the country’s largest commodity exchange, the Multi Commodity Exchange. Volatility and speculation have been a concern for India’s commercial participants and pleas to address these issues encouraged SEBI officials to suspend trading.

The US balance sheet shows higher beginning stocks, production, exports, and ending stocks.

Production is raised 1.3 million bales with larger prospects for most major producing states compared with last month. The projected US season-average farm price is forecast down 1 cent to 96 cents per pound.

Global cotton prices

Global cotton prices were mixed following last month’s WASDE. Both the A-Index and US price were mostly unchanged despite a significantly lower projected US crop in last month’s report. Prices on the Intercontinental Exchange (ICE) surged to more than 115 cents per pound before falling back to levels around 100 cents.

Prospects for higher US interest rates pressured US commodity index funds with the Bloomberg Spot Commodity Index lower than last month. China prices continued to decline and reflect burgeoning commercial stocks in the Xinjiang province before the onset of harvest. Prices in India fell more precipitously relative to other origins as the Securities and Exchange Board of India (SEBI) temporarily suspended trading of 2023 cotton futures on the country’s largest commodity exchange, the Multi Commodity Exchange. Volatility and speculation have been a concern for India’s commercial participants and pleas to address these issues encouraged SEBI officials to suspend trading.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.