How Is China's Home Textile Industry Faring

Analysis On Semi-Annual Reports Of Listed Home Textile Enterprises

Semi-annual reports of listed home textile enterprises are released successively in late Aug.

Semi-annual report analysis

| Brand |

Province |

Stock code |

Time to market |

Total market value (BLN yuan) |

Closing price on Aug 30, 2022 |

| Luolai |

Jiangsu |

002293 |

2009.9.10 |

8.87 |

10.58 |

| Fuanna |

Guangdong |

002327 |

2009.12.30 |

4.881 |

7.09 |

| Mendale |

Hunan |

002397 |

2010.4.29 |

4.045 |

5.35 |

| Sunvim |

Shandong |

002083 |

2006.11.24 |

4.386 |

5.34 |

| Mercury |

Shanghai |

603365 |

2017.11.20 |

3.56 |

13.35 |

| Truelove |

Zhejiang |

003041 |

2021.4.6 |

1.973 |

16.14 |

Mercury is located in Shandong, suffering the severe epidemic in the first half of the year, but it achieves net growth of operating revenue (1.642 billion yuan). It is not only because Mercury has prepared for facing the epidemic, but also because the e-business has taken a half of its shares. The online sales keep increasing to reach 913 million yuan, an increase of 13.28% year on year.

Operation features:

1) Sales areas are mainly East China and Central China.

2) Target customers: biased towards the first and second tiers, developing towards the third and fourth tiers. And some specific groups, such as middle-to-high-end income groups, 20-40-year-old group with lifestyles of health and sustainability, 25-39-year-old women, young group, etc.

3) Various online and offline marketing methods, multi-platform propagandizing. The proportion of e-commerce is divided, but the overall growth rate is relatively fast.

4) A few brands pay more attention to the use of green fibers, and the green economy of the industry has entered a period of formation. New products continue to be developed.

Risks:

1) The dilemma of macro environment, such as the recession of the macro economy, the slowdown in the growth of residents' income, and the further intensification of industry competition.

2) Demand weakens with continued outbreaks of epidemic. Durable goods consumption cycles and consumption patterns change.

3) Risks of volatile production costs.

4) High inventory and risks of depreciation of inventory.

5) Financial Risks

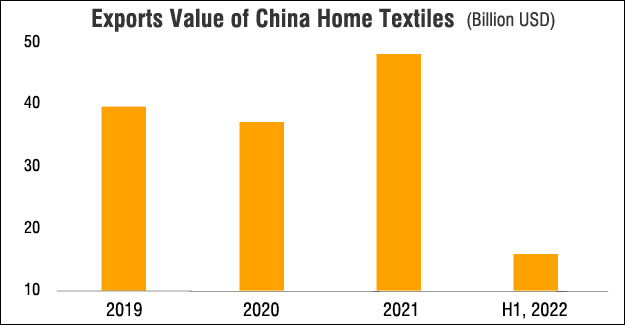

Export-up first and then down

Since the second half year of 2020, the household products have become the best-selling products in the European and American markets, and the export in 2021 also hit a new high, reaching US$47.925 billion, a year-on-year increase of 29.36%. In the first half of 2022, China's home textiles exports reached US$15.62 billion, a slight increase of 0.19% year-on-year.

In the second half year, the home textiles exports face increasing uncertainties under the supply recovery outside China, high inflation in Europe and U.S. and the consumption trend change after epidemic. Market confidence lacks overall and Chinese local sales also face pressure.

Chinese local sales condition-improves somewhat, but lacks confidence in high season

Dieshiqiao Home Textile Market is the largest home textile market in China. From May, Qieshiqiao Prosperity Index and Purchasing Managers’ Index have recovered gradually. From Jul, the index began to be close to the level of the same period of 2021. But except 2020, the Prosperity Index during Aug and Nov in previous years was relatively high, while this year, exports face uncertainties, and local sales are dragged down by the epidemic, low consumption confidence and unfavorable real estate market. The level may be hard to reach the level during the high season of previous years. In Aug, filling products sales turn better apparently, and HC PSF inventory reduces.

Market outlook-firm in Sep, depressed in Q4

In Sep, the market is expected to be optimistic with caution. HC virgin PSF market may fluctuate following the cost side, and operating rate tends to climb up gradually. A few plants that have shut for long time may restart, and some flexible lines will turn to HC virgin PSF. Therefore, HC virgin PSF supply is likely to increase. HC re-PSF prices are expected to rise by 200-300yuan/mt mostly, partly higher by 300-500yuan/mt. In addition to the improved demand, tight feedstock supply is also a factor to make HC re-PSF prices easy to rise. Moreover, PTA plant operating rate is low in Sep, which may maintain at around 70%, which is supportive to HC virgin PSF.

In the fourth quarter, polyester supply may continue to increase, and the market is expected to be soft. But PET flakes supply tends to reduce with lower temperature. Recycled chemical fiber markets may face the dilemma.

Textile Excellence

Previous News

Wonderful Outdoors Experience: Eagle Spotting in Alaska

Next News

The only thing that overcomes hard luck is hard work