China's Textile And Apparel Exports Outperform Domestic Sales During Jan To Jul

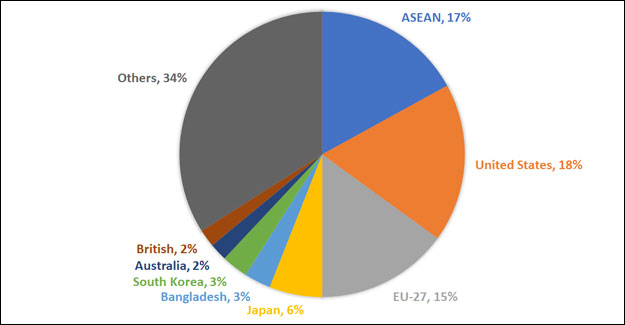

China reported sluggish domestic sales during Jan-July this year. Retail sales of garments, footwear, hats and knitwear above designated size declined by 5.6% year-on-year. In perspective of monthly sales, only June and July saw positive year-on-year growth, but the growth was limited. On the other hand, China’s textile and apparel exports were doing well compared with the domestic sales. During Jan-July, the total exports of China’s textile and apparel goods amounted to US$ 189.84 billion, up 12.7% year-on-year, among which garments exports toppled US$ 99.9 billion, up 13.3% year-on-year. Viewed from the proportion of major products exported, knitted garments made of chemical fibre took the largest part, and cotton knitted garments came second, followed by woven fabrics made of chemical fibres, and other fabrics accounted for 9.2%. From Jan to July, the share of fabric export was rather large, accounting for about 23% of the total textile and apparel exports. In Jan to July, China’s exports of textile and apparel made of chemical fibres performed better than cotton goods. One of the reasons lied in the ban on Xinjiang cotton, and another reason was that the unit price of cotton products increase faster than products made of chemical fibres, thus some orders were shifted to different regions or varieties. EU countries, the US, Japan and ASEAN countries were still the major destinations for China’s textile and apparel exports in Jan-Jul. In particular, the year-on-year growth of exports to ASEAN and Bangladesh increased more rapidly to reach 23% and 36% respectively. The proportion of China’s textile and apparel exports in Europe, the US and Japan moved down gradually. The proportion in the US, in particularly, declined rapidly since the US-China trade war. Although China’s textile and apparel still held a dominant position in those countries, especially in Japan, yet it was worth noticing that parts of the share was being squeezed by Southeast and South Asia countries. China is in the middle of an outward shifts of its low-end textile and apparel industry, and this is expected to continue in the future. However, given the limited capacity and incomplete industrial chains, Southeast and South Asia countries are highly dependent on imports particular imports from China.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.