US Buyers Continue To Diversify Supply Chain Away From China

The US Fashion Industry Association (USFIA)’s Benchmarking Study confirms that US buyers and retailers will reduce orders in 2022 compared to 2021. Signs of slowdown in orders have been evident since February 2022. Bangladeshi exporters have confirmed that orders are severely strained for the period from July 2022 to February 2023.

Increasing production and sourcing costs, inflation and apprehensions of economic slowdown are the main reasons cited by US buyers for the reduction in orders. Over 90% of respondents expect their sourcing value or volume to grow in 2022, but more modestly than last year.

Supply chain diversification more visible now

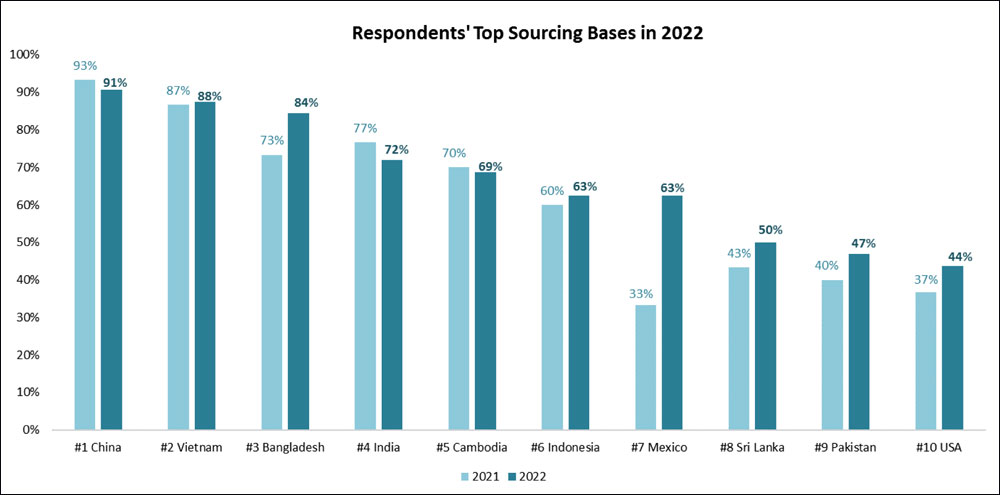

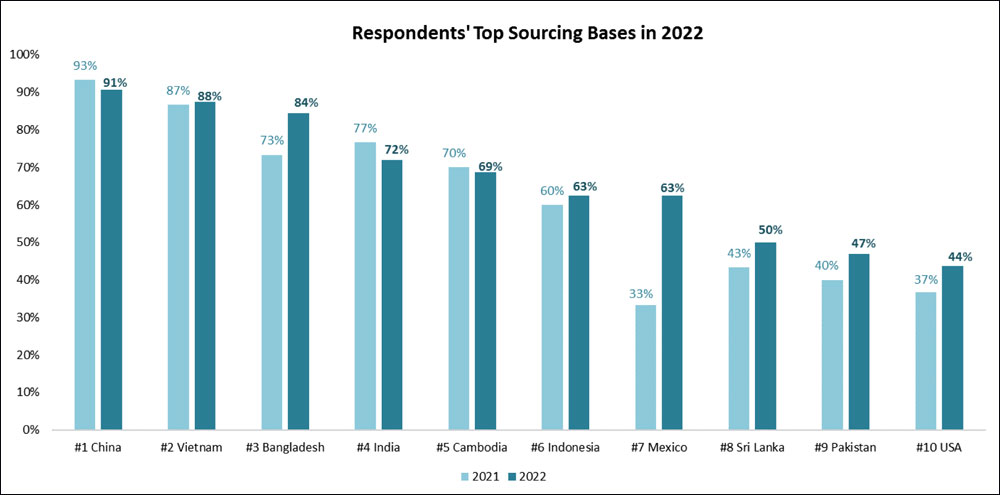

US fashion companies are adopting a more diverse sourcing base in response to supply chain disruptions and the need to mitigate growing sourcing risks. Asia, of course, remains the dominant sourcing base led by China, Vietnam, Bangladesh and India. Buyers have been following the China+1 and China + many sourcing strategy for many years now, the impact of which is becoming visible. In the benchmarking survey of USFIA, in 2022, more than half the respondents report sourcing apparel from over ten countries, compared with just 37% in 2021.

In fact, one third of the respondents report sourcing less than 10% of their apparel products from China this year, a statistic that was difficult to fathom till some years ago. And 50% of the respondents said they are sourcing more from Vietnam than China in 2022. It would be interesting to see how supply chains diversify further, as nearly 40% of respondents plan to source from more countries and work with more suppliers over the next two years, up from only 17% last year.

Uyghur Forced Labor Prevention Act (UFLPA) further speeds up supply chain diversification

Managing the risk of forced labour in the supply chain is a top priority for US fashion companies in 2022, especially with the new implementation of the Uyghur Forced Labor Prevention Act (UFLPA). While 85% of respondents plan to cut their cotton apparel imports from China, another 45% are expected to further reduce non-cotton apparel imports from the country. While over 92% of respondents do not plan to reduce apparel sourcing from Asian countries other than China. nearly 60% of respondents would explore new sourcing destinations outside Asia in response to UFLPA.

Sourcing destinations of interest to US buyers

There is considerable excitement about increasing apparel sourcing from members of the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR). About 20% of respondents place more than 10% of their regional sourcing orders from the region. Only 7% of respondents did so in 2021.

Over the next two years, more than 60% of respondents plan to increase apparel sourcing from CAFTA-DR members as part of their sourcing diversification strategy. The CAFTA-DR offers duty-free benefits when sourcing apparel from the region, besides speed to market, and thus lower sourcing costs. Moreover, exceptions to the `yarn-forward’ rules of origin, such as the `short supply’ and `cumulation’ mechanisms, provide essential flexibility that encourages more apparel sourcing from CAFTA-DR members.

US buyers would prefer more flexibility in the agreement – allowing more flexibility in souring fabrics from outside CAFTA-DR and improving yarn production capacity and variety within CAFTA-DR.

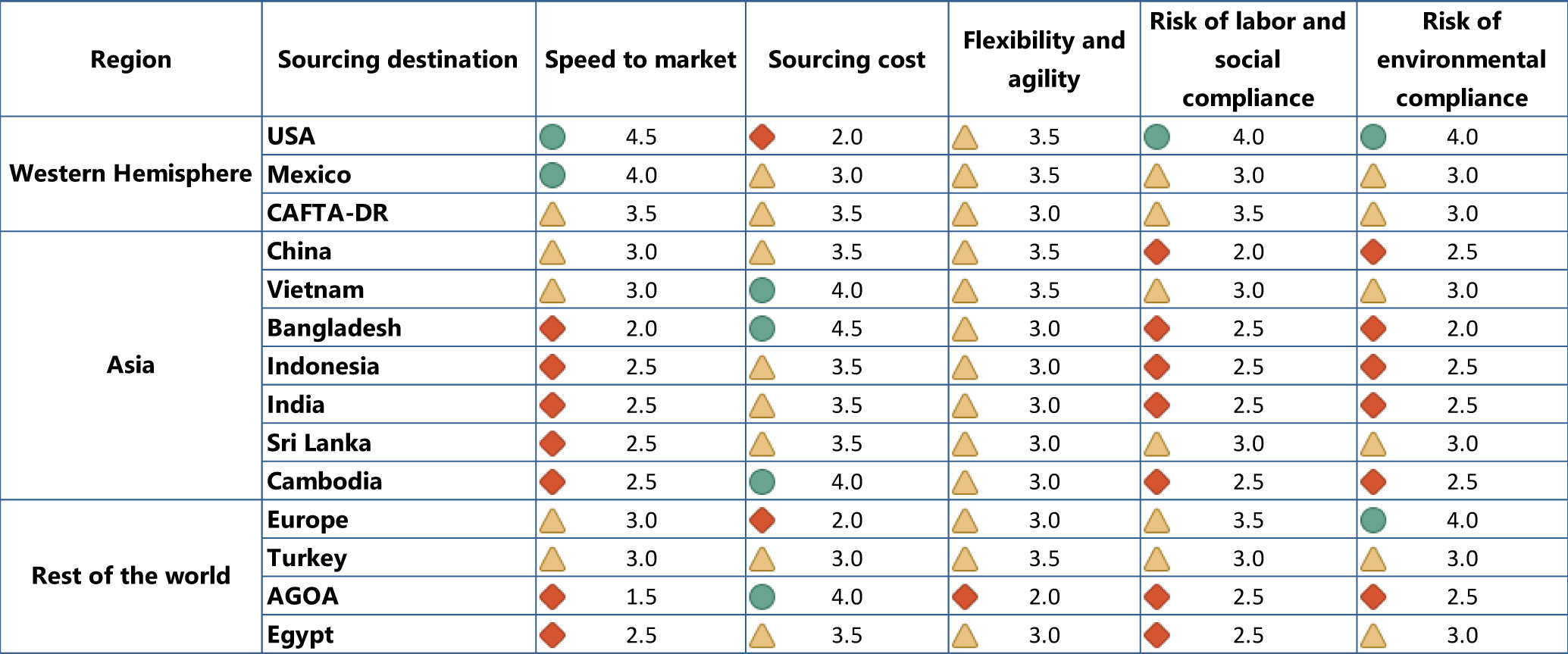

Strengths and weaknesses of primary sourcing bases in 2022—by country

Uyghur Forced Labor Prevention Act (UFLPA) further speeds up supply chain diversification

Managing the risk of forced labour in the supply chain is a top priority for US fashion companies in 2022, especially with the new implementation of the Uyghur Forced Labor Prevention Act (UFLPA). While 85% of respondents plan to cut their cotton apparel imports from China, another 45% are expected to further reduce non-cotton apparel imports from the country. While over 92% of respondents do not plan to reduce apparel sourcing from Asian countries other than China. nearly 60% of respondents would explore new sourcing destinations outside Asia in response to UFLPA.

Sourcing destinations of interest to US buyers

There is considerable excitement about increasing apparel sourcing from members of the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR). About 20% of respondents place more than 10% of their regional sourcing orders from the region. Only 7% of respondents did so in 2021.

Over the next two years, more than 60% of respondents plan to increase apparel sourcing from CAFTA-DR members as part of their sourcing diversification strategy. The CAFTA-DR offers duty-free benefits when sourcing apparel from the region, besides speed to market, and thus lower sourcing costs. Moreover, exceptions to the `yarn-forward’ rules of origin, such as the `short supply’ and `cumulation’ mechanisms, provide essential flexibility that encourages more apparel sourcing from CAFTA-DR members.

US buyers would prefer more flexibility in the agreement – allowing more flexibility in souring fabrics from outside CAFTA-DR and improving yarn production capacity and variety within CAFTA-DR.

Strengths and weaknesses of primary sourcing bases in 2022—by country

Ethiopia losing AGOA benefits has impacted sourcing from the region

US fashion companies strongly support another ten-year renewal of the African Growth and Opportunity Act (AGOA). Meanwhile, Ethiopia’s loss of AGOA eligibility discourages US apparel sourcing from the entire AGOA region, given that AGOA had helped Ethiopia, more than other African countries, to build its textile and apparel industry. Notably, no respondent plans to move sourcing orders from Ethiopia to other AGOA beneficiaries.

Respondents reported sourcing from Lesotho, Ethiopia, Kenya, Madagascar, Tanzania, and Ghana this year, but primarily for less than 10% of their total sourcing value or volume.

US buyers believe that a 10-year AGOA renewal will encourage more apparel sourcing from the region and allow for investment commitments. However, despite the tariff benefits and the liberal rules of origin, respondents express explicit concerns about the region’s lack of competitiveness in speed to market, political instability, and having an integrated regional supply chain.

Tracking, traceability is gaining importance

Mapping and understanding the supply chain is a critical strategy to address the forced labour risks in the supply chain. Almost all respondents currently track Tier 1 and 2 suppliers. With the help of new traceability technologies, 53% of respondents have begun tracking Tier 3 suppliers this year (i.e., those manufacturing yarn, threads, and trimmings), a substantial increase from 25-36% in the past.

Suppliers across the value chain will need to start investing in these mapping solutions, even as they find no tangible returns on such investments.

Ethiopia losing AGOA benefits has impacted sourcing from the region

US fashion companies strongly support another ten-year renewal of the African Growth and Opportunity Act (AGOA). Meanwhile, Ethiopia’s loss of AGOA eligibility discourages US apparel sourcing from the entire AGOA region, given that AGOA had helped Ethiopia, more than other African countries, to build its textile and apparel industry. Notably, no respondent plans to move sourcing orders from Ethiopia to other AGOA beneficiaries.

Respondents reported sourcing from Lesotho, Ethiopia, Kenya, Madagascar, Tanzania, and Ghana this year, but primarily for less than 10% of their total sourcing value or volume.

US buyers believe that a 10-year AGOA renewal will encourage more apparel sourcing from the region and allow for investment commitments. However, despite the tariff benefits and the liberal rules of origin, respondents express explicit concerns about the region’s lack of competitiveness in speed to market, political instability, and having an integrated regional supply chain.

Tracking, traceability is gaining importance

Mapping and understanding the supply chain is a critical strategy to address the forced labour risks in the supply chain. Almost all respondents currently track Tier 1 and 2 suppliers. With the help of new traceability technologies, 53% of respondents have begun tracking Tier 3 suppliers this year (i.e., those manufacturing yarn, threads, and trimmings), a substantial increase from 25-36% in the past.

Suppliers across the value chain will need to start investing in these mapping solutions, even as they find no tangible returns on such investments.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.