Highest US Cotton Product Imports in 11 Years Support Record Global Cotton Consumption

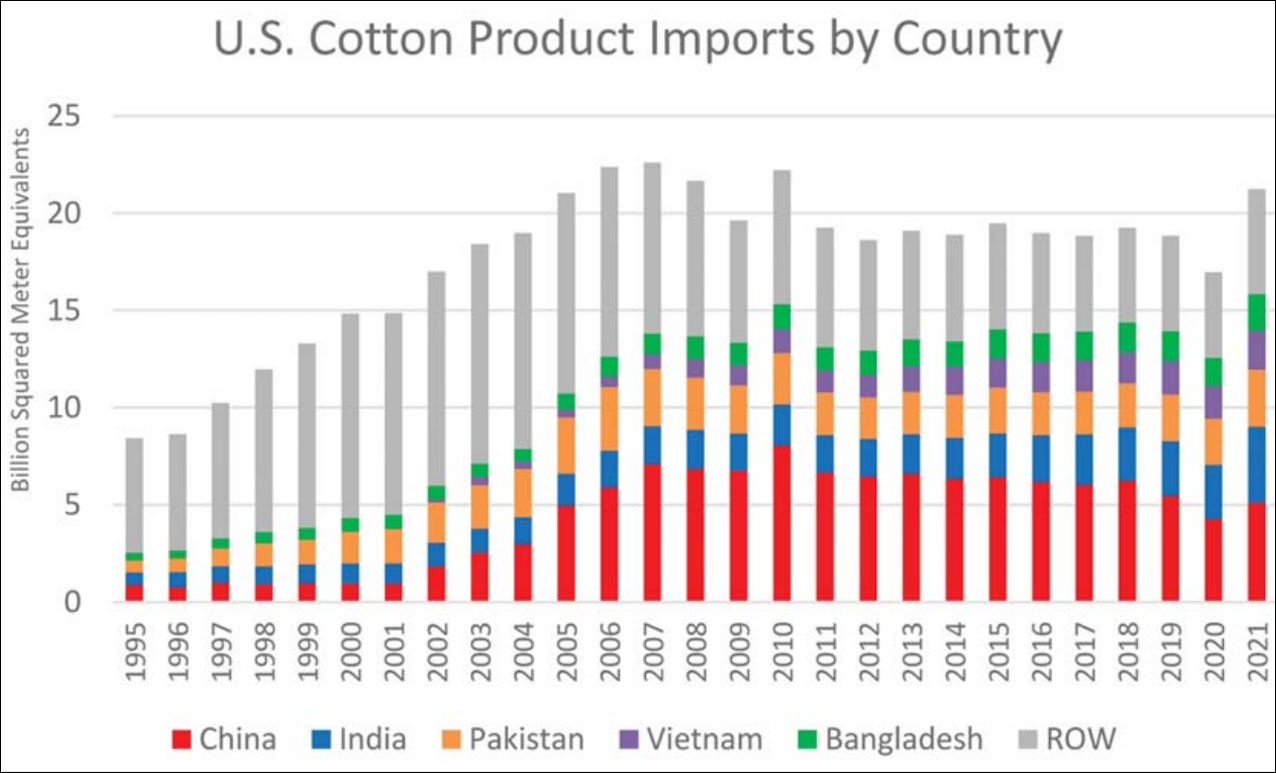

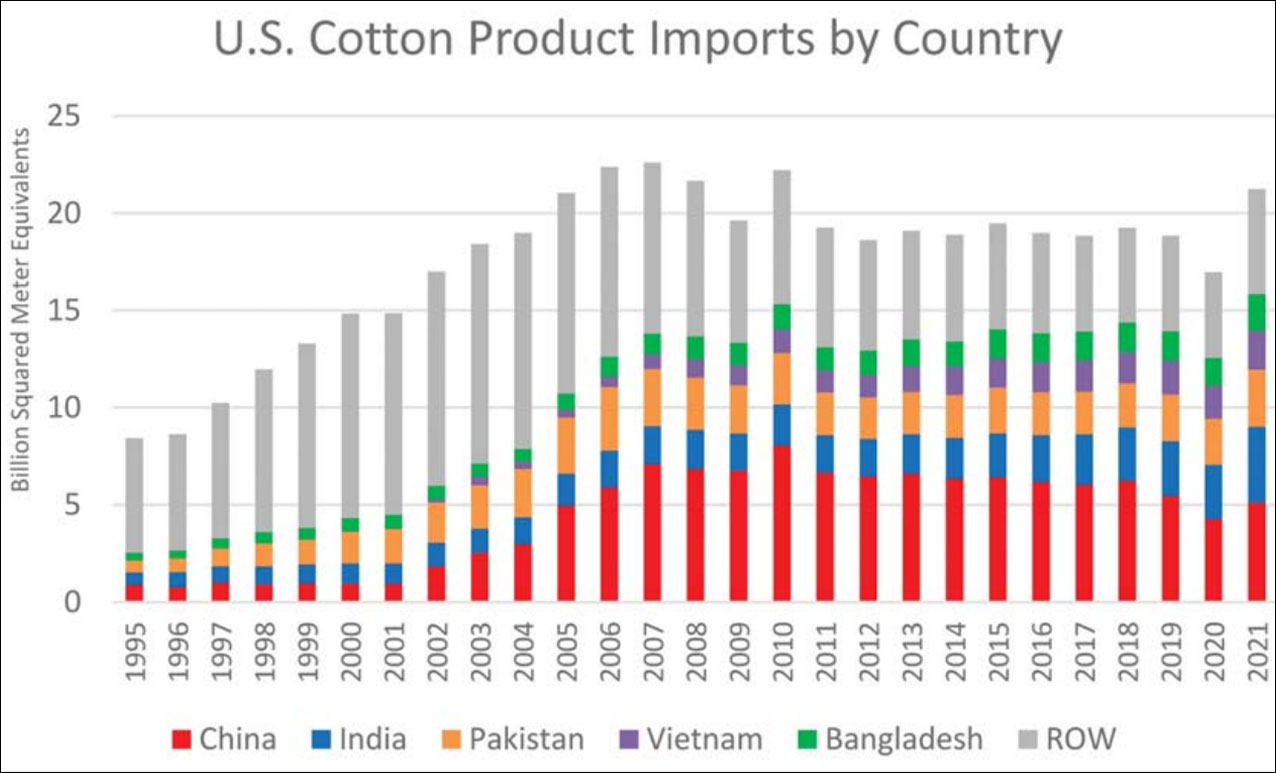

The United States imports nearly all the cotton products (i.e., cotton apparel, home textiles, etc.) that US consumers purchase in retail outlets. US imports of cotton products in calendar year 2021 were the highest since 2010 and are expected to further support forecast record cotton consumption in marketing year 2021/22 (Aug-Jul).

The United States is the largest importer of cotton products, and the country’s demand is a significant factor in the quantity of cotton spun into yarn, hence a harbinger of global cotton lint consumption.

According to data from the International Trade Administration’s Office of Textile and Apparels (OTEXA), 2021 imports of cotton products were US$ 49 billion, comprised of more than 21 billion square meter equivalents (SME) and boosted by strong US consumer demand for cotton apparel and home textiles (e.g., towels, bed sheets, etc.).

As a portion of consumers continued working from home, appetite for comfortable and soft knitted garments boosted demand for cotton apparel, and strong US home purchases and improvements necessitated new home textiles. Moreover, pent-up demand from the previous year and an increase in discretionary income also boosted imports after 2020 US cotton product imports fell to the lowest level in nearly 20 years.

China remained the largest cotton product supplier for the 19th consecutive year. This was despite Section 301 tariffs implemented in 2019 amid the US-China trade dispute and the US Customs and Border Protection’s Withhold Release Order on all cotton-derived products from the Xinjiang autonomous region. This area produces more than 90% of China’s cotton. However, imports from China have fallen from a record 8.0 billion SME in 2010 to 5.1 billion SME in 2021. Other countries have made significant strides since that period – imports from India, Vietnam, and Bangladesh were all records in 2021.

Both US cotton product imports and global cotton consumption trend closely. For the first 5 months of marketing year 2021/22 (Aug. – Dec.), US cotton product imports have remained robust, and December 2021 was a record for the month. Despite rising inflation concerns for consumers, strong US disposable income and recently strong imports are expected to further support record 2021/22 global cotton consumption.

2021/22 Outlook

Global production is lowered 300,000 bales from last month due to a smaller crop in India. Use is up slightly, just over 100,000 bales, and ending stocks are down significantly for the third consecutive month with a decrease of over 1.7 million bales. Global trade is down slightly with lower exports from Malaysia, Brazil, and India.

US production is unchanged at 17.6 million bales. Exports and ending stocks are also unchanged at 14.8 and 3.5 million bales, respectively, and the US season-average farm price is unchanged at 90 cents per pound.

Both US cotton product imports and global cotton consumption trend closely. For the first 5 months of marketing year 2021/22 (Aug. – Dec.), US cotton product imports have remained robust, and December 2021 was a record for the month. Despite rising inflation concerns for consumers, strong US disposable income and recently strong imports are expected to further support record 2021/22 global cotton consumption.

2021/22 Outlook

Global production is lowered 300,000 bales from last month due to a smaller crop in India. Use is up slightly, just over 100,000 bales, and ending stocks are down significantly for the third consecutive month with a decrease of over 1.7 million bales. Global trade is down slightly with lower exports from Malaysia, Brazil, and India.

US production is unchanged at 17.6 million bales. Exports and ending stocks are also unchanged at 14.8 and 3.5 million bales, respectively, and the US season-average farm price is unchanged at 90 cents per pound.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.