Impact Of Russia-Ukraine War On Global T&C Industry

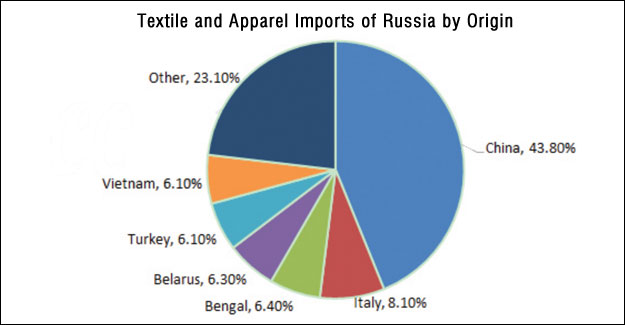

The impact of the Russia and Ukraine war on global cotton textile industrial chain is gradually expanding. Among the major import origins of textile and apparel in Russia, the proportion from China takes a high of 43.8%, followed by Italy 8.1%, Bangladesh 6.4%, Republic of Belarus 6.3%, Turkey 6.1% and Vietnam 6.1%. Viewed from the China and Russia relations and global trade change, the market shares of China in Russian textile and apparel imports may increase further in long run, to fulfill the supply gap caused by the sanctions from Europe and US. For China, the textile and apparel exports to Russia take a very small proportion, easy to meet the new demand from Russia. However, restrained by the large export shares of EU, Japan and US for China, if the war influences the relations between EU, Japan, US and China, China’s textile and apparel exports may face obvious pressure. Since Italy is a member of the EU and NATO, the relationship between Russia and the EU and NATO has become tenser after the outbreak of the Russian-Ukrainian war, which will inevitably affect their economic and trade relations. In general, the economic and other sanctions caused by the Russian-Ukrainian war may lead to a decrease in the export of textiles and clothing from several major exporting countries to Russia, and this part of the decrease may be fulfilled by China. However, since Russia's textile and apparel import demand accounts for a relatively small proportion in the world, the Russian-Ukrainian war may more affect global trade flows, while its impact on total demand may be relatively limited. Meanwhile, Russia is also a major exporter of fertilizers. In 2021, the export volume of urea is 7 million tons, accounting for 3.56% of global production. Global cotton planting costs are likely to keep increasing with higher prices of fertilizers. The planting areas in 2022/23 season still have large uncertainties. In addition, the war has also led to a shortage of seafarers, and the global supply chain may face the risk of disruption. The Seafarer Workforce Report, published in 2021 by BIMCO and ICS, reports that 1.89 million seafarers are currently operating over 74,000 vessels in the global merchant fleet. Of this total workforce, 198,123 (10.5%) of seafarers are Russian and Ukraine accounts for 76,442 (4%) of seafarers. Combined they represent 14.5% of the global workforce. 26,000 seafarers may be lacked in the next four years. International sea freight may keep high for long time. (CCF)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.