Textile Budget Analysis

State of Indian Textile & Apparel Industry During Pandemic

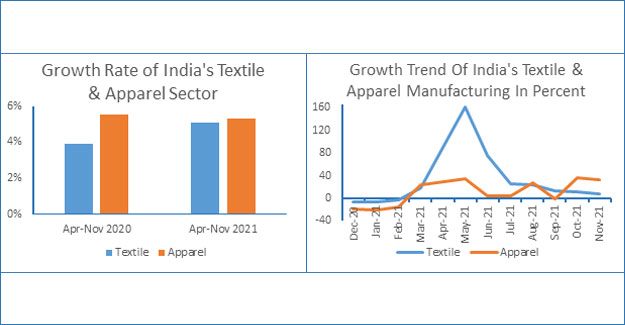

- Improvement in the manufacturing performance of the textiles & apparel sector kept the industry actively engaged despite Covid-19 challenges as well as contributed significantly towards employment creation. The industry employs around 105 million people directly and indirectly.

- Inflation in manufacture of textiles also remained high at 15.3 per cent during this period pushed up by the rise in the prices of textile fibres between April – December 2021.

- Clothing and footwear witnessed a rising price trend during April – December 2021, indicating higher production and input costs as well as due to revival of consumer demand.

- In the last decade, Textile industry has witnessed an investment of approximately Rs. 203,000 crores.

- India's Textile & Apparel exports during April-December 2021 touched US$ 29.8 billion, up 31% year-on-year.

- Ministry of Textiles has been allocated Rs 12382.14 crores for FY 2022-23 in comparison to Rs 11449.32 cores in revised budget estimates of FY 2020-21. This is an increase of which is about 8.1 per cent higher than the previous budget.

- Budget allocation to Cotton Corporation of India (CCI) for procurement of cotton under MSP Scheme increased by 9.5% to Rs 9,243.09 crores.

- Amended Technology Upgradation Fund Scheme(ATUFS) received an allocation of Rs 650 crores, while Integrated Scheme for Skill Development scheme and National Technical Textiles Mission received Rs 100 crores each.

- Wool and Wool waste shall draw a reduced custom duty of 5% from 1st may 2022. Similarly, Wool Tops to attract a custom duty of 2.5% and all other goods (like 5103 10 90, 5103 30 00) shall attract a custom duty of 10%

- Custom Duty on Cotton (5201) shall be 5% while Flax (5301) will have zero custom duty with effective from the 1st May, 2022. On the other hand, raw Jute (5303) will attract a custom duty of 5% with effective from the 1st May, 2022.

- Some of the textile yarns and fibers that the domestic industry depends on import would draw a lower Custom Duty of 2.5%. These products are Nylon 66 Filament (5402 19 90), Polyester Anti-Static Filament Yarn (5402 52 00), Aramid Flame Retardant Fibre (5503 11 00), Para- aramid Fibre (Para- aramid Fibre), Nylon Staple Fibre (5503 19 00), Nylon Anti Static Staple fibre (5503 19 00), Modacrylic fibre (5503 30 00), Flame Retardant VSF (5504 10 00) etc.

- Tariff rate for all textile items shall be reduced with effect from 1st May 2022 and readers may look up to custom notifications for exact applicable BCD rate. For the period of 2nd Feb 2022 - 30th April 2022, the rate on most of textile item shall operate through Custom notification No. 82/2017-Customs which is being amended to incorporate effective BCD on textile items (refer Custom notification No. 7/2022-Customs, dated 1st February, 2022 and No. 05/2022-Customs, dated 1st February, 2022).

- The effective BCD on certain textile items under 6001, 6101, 6102, 6103, 6104, 6201, 6202, 6203, 6204 are composite rates, with different rates of specific duty. Duty on some of these items are replaced by ad-valorem rates only. Therefore, SWS exemption for these items is being withdrawn with effect from 2nd February, 2022 (refer Custom notification No. 03/2022-Customs dated 1st February, 2022).

- Garment & apparel accessories and embellishments like zipper, buttons, magnet buttons, buckles, fusible embroider prints, lining and inter-lining materials, collar stays and patties etc. are exempted from Custom duties when imported by bonafide exporters for use in the manufacture of textile or leather garments for export. These goods already enjoyed duty free imports.

- Concessional BCD rate to be withdrawn for Spindles, Yarn guides, Balloon Control Rings and Travellers with effective from 1st April 2022.

- Concessional BCD rate of 5% to be withdrawn for the remaining items such as machinery for continuous polymerization plant, machinery for synthetic fibre plant, Machinery for synthetic filament yarn plant, machinery for regular/HWM VSF plant, machinery for Lyocell Fiber plant shall be removed with effective from 1st April 2023.

- Concessional BCD on machinery as specified in List 12 (such as machinery for garment sector, machinery for manufacture of technical textiles, woolen textile machinery items, machinery for manufacture of non-wovens textiles, machinery for manufacture of denim fabrics, machinery for use with shuttleless looms etc.) shall be removed with effective from 1st April 2023.

- Concessional BCD rate to be withdrawn for machinery in List 25 (such as ETP with biopaq reactor, activate sludge process, activated carbon, ultrafiltration ozonisation facilities, RO, vacuum filters etc. shall be removed with effective from 1st April 2022.

- Concessional BCD rate to be withdrawn for the remaining machines such as singeing machines, yarn drying machines, knitting machines etc. with effective from 1st April 2023.

- Machinery or equipment for ETP for handloom or handicraft sector shall be removed from 1st April 2022.

- Machinery for use in the silk textile industry will also draw higher BCD with effective from 1st April 2023.

- Concessional BCD rate to be withdrawn for Card Clothing (HS Code 8448 31 00) with effective from 1st April 2022

- Further, concessional BCD rate to be withdrawn for machines for extruding, drawing, texturing, textiles machines, machines for preparing textile fibers, textile spinning machines, textile twisting machines, textile winding machines, weaving machines, knitting machines, auxiliary machines etc., with effective from 1st April 2023.

Textile Excellence

Subscribe To Textile Excellence Print Edition

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.