Indian Spinning Industry – A “Black Hole” For Indian Cotton

The title of this column may seem a bit funny, but this season we have witnessed the real capacity of Indian spinning mills – their cotton consumption drastically jumped from 30-32 million bales to 35-36 million bales, and it can go up further. This has posed a new challenge for estimating India’s cotton consumption. From the start to the end of the season, cotton consumption estimates have kept increasing.

And that’s why I describe it as a black hole – the ever increasing demand for cotton by spinning mills has left very little cotton in the market. We had a huge opening stock of 12.3 million bales, good quality Indian cotton production was approximately 35 million bales. The trade was expecting a good ending stock too for the season, but with the high domestic consumption and exports, ending stocks are going to be marginal.

Strong demand, lower ending stocks, firm cotton prices

Indian cotton is trading on bullish note with strong demand from local mills. CCI continues to sell good volumes even at higher prices. CCI now has limited stocks of around 800,000 to 1 million bales. Traders and mills are holding most of the stocks, ginners are also carrying some stocks.

Mill’s are reportedly carrying cotton stocks of around 8.5 to 9 million bales (Average 75-90 days consumption). Apart from this, ginners/traders/MNCs also having some stocks of around 1.1-1.3 million bales. (These numbers are based on general market feedback as on date, actual numbers can differ).

Export numbers are reported around 7.2 million bales till now, till end of the season it is expected to cross 7.5 million bales, which is higher than estimated earlier in the season.

ICE is trading quite firm moving up at a slow pace; December contract crossed 90 USC and is trading around 91 USC level. If cotton trades higher that this, the market can enter another bullish zone. US and India have reported conducive weather conditions for cotton, but this has failed to control the spiralling cotton prices.

Indian cotton prices moved up 45% this season

Indian Cotton 29mm/3.7MIC/74-75RD Value/S6 is trading around Rs 56,000 per candy, which gives USC 96 per LBS ex-warehouse in Gujarat (considering current USD/INR exchange rate). This is around 5 USC expensive than current ICE December contract.

About a month back, Indian cotton prices were around Rs 51,000 per candy for 29mm Gujarat cotton and ICE cotton December contract was trading around USC 87 per lbs. That time, Indian cotton prices were at par with ICE cotton prices.

However, in a month’s time, an approximate 10% hike in prices has been observed which is considerably high. Mills also reported that they are working with lower margins as yarn prices did not appreciate with cotton prices. Spinning mills may be still making money but for sure profits went down with higher cotton prices. If we consider prices from start of the season October 1st, 2020, then Indian market jump is above 45% which is really high.

We are just 60 days away from entering the new season. If we consider all estimated numbers together, ending stock could be around 5-6 million bales. Which is lower in comparison to last year’s closing stock; but it’s a decent number if new crop arrivals start on time with minimum hurdles in the next 45-60 days.

In the given circumstances, at start of new season (2021-22) cotton is expected to trade above new MSP, but it’s still early days.

Higher MSP and good experience of the previous two years of CCI cotton purchases should give farmers the confidence to not sell below MSP, this can be a major factor to set a bottom line for Indian cotton prices in new season. Moreover, holding capacity of farmers is increasing and with the given situation, prices could sustain above MSP.

Cotton Sowing

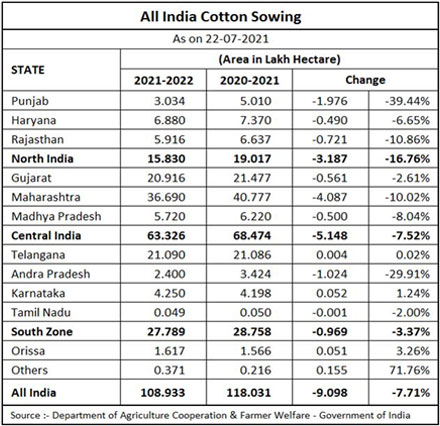

Sowing across India has accelerated after recent good rainfall across India. Gujarat, Maharashtra and Telangana have almost completed sowing.

India is expected to have higher cotton yield this season, subject to climatic and pest conditions. All India sowing has been reported around 11 million hectares as of now, still sowing is in progress at very few places which can add some more numbers in final sowing area.

Cotton arrival in northern part of India is expected from September first week, which is expected to have some sentimental pressure on market price but ICE will certainly play a big role on Indian prices now. With current scenario, bulk cotton arrival should start after 20th October. This year, farmers are optimistic to get much better prices than the current year. This can disrupt arrivals as farmers will wait for the best price. It’s advisable to avoid taking long term calls in this unpredictive scenario.

US cotton export sales for week ending July 22, 2021

Net sales reductions of 1,200 RB for 2020/2021 - a marketing-year low - were down noticeably from the previous week and from the prior 4-week average. Increases reported for Mexico (2,400 RB), Pakistan (900 RB), Peru (500 RB), South Korea (400 RB), and Egypt (100 RB), were more than offset by reductions for Indonesia (2,200 RB), Vietnam (2,000 RB), China (900 RB), and Japan (400 RB).

For 2021/2022, net sales of 192,200 RB primarily for Bangladesh (55,000 RB), Mexico (39,600 RB), Pakistan (33,700 RB), Vietnam (25,300 RB), and Turkey (14,300 RB), were offset by reductions for Guatemala (200 RB). Exports of 238,300 RB were down 3% from the previous week and 5% from the prior 4-week average. Exports were primarily to Turkey (54,200 RB), Pakistan (48,800 RB), Vietnam (29,300 RB), China (27,500 RB), and Indonesia (18,500 RB).

Net sales of Pima totaling 4,200 RB were up 22% from the previous week, but down 2% from the prior 4-week average. Increases were primarily for Peru (2,300 RB) and India (900 RB). For 2021/2022, net sales of 200 RB were reported for Thailand (100 RB) and Japan (100 RB). Exports of 9,300 RB were down 10% from the previous week and 14% from the prior 4-week average. The destinations were primarily to India (6,300 RB), Peru (1,500 RB), China (700 RB), Germany (400 RB), and Pakistan (200 RB).

Sowing across India has accelerated after recent good rainfall across India. Gujarat, Maharashtra and Telangana have almost completed sowing.

India is expected to have higher cotton yield this season, subject to climatic and pest conditions. All India sowing has been reported around 11 million hectares as of now, still sowing is in progress at very few places which can add some more numbers in final sowing area.

Cotton arrival in northern part of India is expected from September first week, which is expected to have some sentimental pressure on market price but ICE will certainly play a big role on Indian prices now. With current scenario, bulk cotton arrival should start after 20th October. This year, farmers are optimistic to get much better prices than the current year. This can disrupt arrivals as farmers will wait for the best price. It’s advisable to avoid taking long term calls in this unpredictive scenario.

US cotton export sales for week ending July 22, 2021

Net sales reductions of 1,200 RB for 2020/2021 - a marketing-year low - were down noticeably from the previous week and from the prior 4-week average. Increases reported for Mexico (2,400 RB), Pakistan (900 RB), Peru (500 RB), South Korea (400 RB), and Egypt (100 RB), were more than offset by reductions for Indonesia (2,200 RB), Vietnam (2,000 RB), China (900 RB), and Japan (400 RB).

For 2021/2022, net sales of 192,200 RB primarily for Bangladesh (55,000 RB), Mexico (39,600 RB), Pakistan (33,700 RB), Vietnam (25,300 RB), and Turkey (14,300 RB), were offset by reductions for Guatemala (200 RB). Exports of 238,300 RB were down 3% from the previous week and 5% from the prior 4-week average. Exports were primarily to Turkey (54,200 RB), Pakistan (48,800 RB), Vietnam (29,300 RB), China (27,500 RB), and Indonesia (18,500 RB).

Net sales of Pima totaling 4,200 RB were up 22% from the previous week, but down 2% from the prior 4-week average. Increases were primarily for Peru (2,300 RB) and India (900 RB). For 2021/2022, net sales of 200 RB were reported for Thailand (100 RB) and Japan (100 RB). Exports of 9,300 RB were down 10% from the previous week and 14% from the prior 4-week average. The destinations were primarily to India (6,300 RB), Peru (1,500 RB), China (700 RB), Germany (400 RB), and Pakistan (200 RB).

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.