India's Textile And Clothing Exports Fell 16.3% In 2020

India's textile and clothing (T&C) exports in 2020 (Jan to Dec) witnessed a significant drop of 16.3% to US$ 29693.41 million. This is the first time in the last 14 years that textile and apparel exports registered a double-digit fall. T&C exports account for 11% share of the country's total exports for 2020.

Knitted apparel is the top commodity and exports totalled to US$ 6,135.81 million. This was a drop of as much as 22.1% in 2020 over the previous year. The commodity stakes 21% share of the country's total T&C exports. Woven apparel exports at US$ 6,132.44 million, registered a decline of 26.7% in 2020.

USA remains the largest export market for both commodities. Overall too, USA is the top market for India's T&C products.

Knit exports fell despite rising demand of athleisure

Men's t-shirt was witnessing a strong growth in the export market, but due the global Covid-19 pandemic the demand dipped from major markets. Knitted t-shirt exports totalled to US$ 1920.02 million with a decline of 26.6% in 2020 over the previous year. Average unit value realisation was US$ 2.50 per piece in 2020. Under this segment, cotton t-shirt is exported the most, with an export of US$ 1444.65 million with a drop of 26.21% in 2020 over the previous year. Cotton t-shirt was sold at an average price of US$ 2.45 per piece. Knitted cotton babies garment is the second highest exported product in the apparel exports. Exports of this product at US$ 626.05 million, was down by 11.65% in 2020. Average UVR was US$ 17.38 per kg. Average UVR of knitted babies garments made of synthetic fibre saw a significant drop in 2020 to US$ 24.18 per kg, compared to US$ 32.25 per kg in 2019. Export of this product dropped by 53.9% in 2020 to US$ 24.41 million.

Woven apparel exports fell 26.5% in 2020

In the woven apparel segment, other dresses made from synthetic fibre (HS code: 62044390) were exported the most to the world from India. Exports of this product totalled to US$ 483.71 million with a drop of 26.5% in 2020. On an average the product was sold at US$ 8.06 per unit.

Surprisingly, even as MMF is the preferred fibre in global markets, India's exports of weaved other cotton dresses (HS code: 62044290) recorded a growth of 298.5% to US$ 296.23 million. This product fetched an average UVR of US$ 7.98 per unit.

Woven men's shirts made of cotton witnessed a major fall of 79.3% to US$ 171.78 million in 2020.

Cotton textile exports were down 2.7%

Cotton commodity that stakes a share of 20% of the country's total T&C exports, too registered a drop of 2.7% in 2020. India's cotton exports totalled to US$ 5,833.08 million. Bangladesh remains the top market for Indian cotton, with exports totalling to US$ 1708.43 million with growth of 10.5%.

Under this commodity, exports of raw cotton witnessed a growth of 38.2% in 2020 to US$ 1559.60 million. More than 10 lakh kgs of cotton were exported to international markets and on an average, per kg of cotton was traded at US$ 1.47 in 2020, while in 2019 it was US$ 1.70 per kg. Indian cotton yarn exports fell by 7.9% to US$ 2681.91 million and was sold at an average price of US$ 2.65 per kg in 2020. Exports of cotton woven fabrics totalled to US$ 1576.77 million with negative growth of 18.91%. Around 17.22 lakh sqm of woven cotton fabric was exported and on an average the product was sold at US$ 0.92 per sqm in 2020.

Made-ups exports down 7.5%

Other textile made-ups (HS code: 63) too perceived a drop in exports. The export of the commodity fell by 7.5% to US$ 4775.99 million in 2020. Here, exports of curtains and interior blinds grew by 53.1% to US$ 181.09 million. The unit value realisation of this product has gone up by 52.6% with an average price of US$ 13.91 per kg in 2020, while in 2019 it was US$ 9.11 per kg. Exports of bed, table, toilet and kitchen linens fell by 10.23% to US$ 1423.55 million in 2020. On an average, these items were exported at a price of US$ 6.20 per kg.

Silk exports fell 2.8%

India's silk exports totalled to US$ 81.79 million, a dip of 2.8% in 2020. USA is the top market for Indian silk products, exports to USA totalled to US$ 36.41 million with growth of 36.9% in 2020. Woven fabric of silk or silk waste is the most exported product under this commodity. The exports of this product totalled to US$ 60.03 million, but perceived a negative growth of 10.24% in 2020. The UVR's of the woven fabric was US$ 12.35 per sqm.

Wool exports were down 44.30%

Wool exports too have dropped in 2020 by 44.30% to US$ 101.20 million. Korea RP is now the top market of Indian wool products, it has taken over UK in 2020 over the previous year. Exports to Korea RP totalled to US$ 20.46 million, but registered a negative growth of 23.4% in 2020.

Other vegetable textile fibres; paper yarn and woven fabrics of paper yarn commodity (HS code 53) registered a growth 6.1% to US$ 478.05 million in 2020 and stakes 2% share in the total T&C exports of India. China remains the largest market this commodity and exports of China totalled to US$ 96.11 million with growth of 0.7%.

MMF exports were down by 29.8%

Man-made filament exports were down by 29.8% to US$ 1,644.30 million in 2020 and stakes 6% share of the total T&C exports of India. Turkey is the largest market for Indian MMF products. MMF exports to Turkey totalled to US$ 199.83 million, but perceived a drop of 34.8% in 2020. Textured polyester yarn is the most exported product under this category. The export of this product totalled to US$ 463.11 million with a drop of 36.9% in 2020. Average UVR was US$ 1.23 per kg in the export market.

MMSF exports fell 26.9%

Man-made staple fibre too witnessed a drop of 26.9% to US$ 1278.88 million in 2020 in the export market. Here too Turkey remains the top market, exports to turkey totalled to US$ 128.92 million, down 20.2%. Yarns of synthetic staple fibre is the top product under this commodity, with exports of US$ 360.43 million, but dropped by 26.2% in 2020. Yarn of synthetic staple fibre was exported at an average price of US$ 2.18 per kg in 2020.

Synthetic staple fibre is second most exported product under man-made staple fibre and the exports totalled to US$ 225.01 million, down 25.8% in 2020 and product was sold at US$ 0.84 per kg, on average.

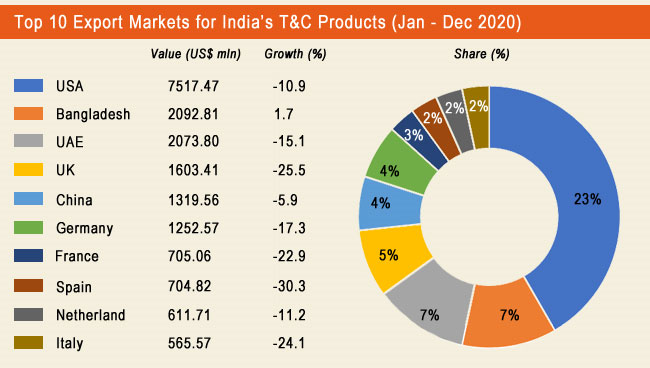

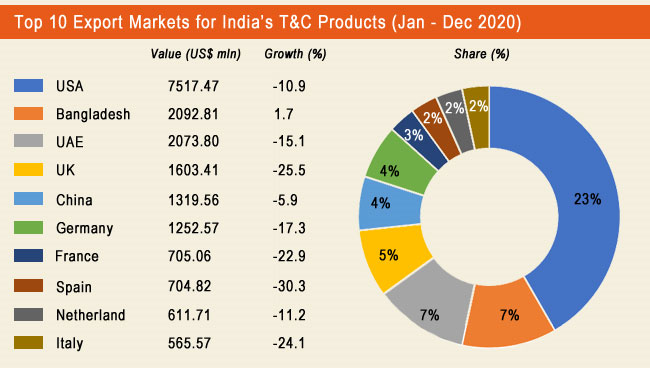

India's top T&C export markets

Among the top 20 export markets, only exports to Bangladesh and Vietnam witnessed a rise, both have climbed few positions up on the list. The rest of the top 18 markets registered a drop in the T&C exports in 2020.

Exports to No. 1 market USA were down 10.9%

Country-wise, USA remains the largest export market for India's textile and clothing goods. In 2020, India's T&C exports to USA totalled to US$ 7517.47 million and perceived a drop of 10.9%.

USA stakes a share of 25% of the total T&C exports of India. The drop in the growth was mainly due to the low demand for Indian apparel goods. India's apparel exports to USA totalled to US$ 3,299.25 million with drop of 24%. Knitted fabric exports growth rose to the highest amongst the others i.e. 64.3% to US$ 107.28 million in 2020.

Bangladesh's huge demand for cotton fibre makes it India's second largest market

Bangladesh is the first country on the list to witness a positive growth and is now the second largest export market for India's T&C goods. Currently Bangladesh stakes 7% share of the total T&C exports of India in 2020 and export value totalled to US$ 2092.81 million with a growth of 1.7%. However, India mainly exports low value commodity inputs to Bangladesh. Cotton is the largest exported commodity to Bangladesh and is the only commodity to witness a positive trend among others. India's cotton exports to Bangladesh grew by 10.5% in 2020 to US$ 1708.46 million. Exports of man-made filament and man-made staple fibre both witnessed a drop in the Bangladesh market. MMF exports dropped by 19.47% to US$ 151.67 million in 2020 to US$ 188.34. And MMSF exports dropped by 21% to US$ 122.95 million in 2020.

Exports to UAE continue to fall

UAE has lost it rank by one position, now standing as the third largest market for India's T&C goods. Exports to UAE fell by 15.1% to US$ 2073.80 million. India exports sizeable quantity of knitted apparels to UAE, but in 2020, the exports of knitted apparels dropped by 20.8% to US$ 891.05 million over the previous year. Exports of woven apparel to the UAE were down by 14.7% to US$ 626.02 million.

Exports to UK were down 25.5%

UK is now the fourth largest market for Indian T&C goods, accounting for 5% of India's total T&C exports. Exports to the fell 25.5% to US$ 1603.41 million in 2020. India mainly exports finished apparel to the UK market. In 2020, apparel exports at US$ 1127.95 million were 29.4% lower than in 2019.

Exports to China remained stable in 2020

China accounts for a share of 4 % of India's total T&C exports. Exports to China fell 5.9% to US$ 1319.56 million in 2020. Cotton is the major commodity exported to China. India's cotton exports to China at US$ 1014.83 million, witnessed an insignificant drop of 0.2%.

Cotton fibre most exported commodity to Vietnam

Vietnam is the second country in the top 20 that has perceived a positive growth. Exports to Vietnam rose by 18.2% to US$ 402.53 million in 2020. Here too, India supplies more of cotton fibre. India's cotton exports to Vietnam totalled to US$ 335.86 million, up 45.4% in 2020 over the previous year.

Exports to UAE continue to fall

UAE has lost it rank by one position, now standing as the third largest market for India's T&C goods. Exports to UAE fell by 15.1% to US$ 2073.80 million. India exports sizeable quantity of knitted apparels to UAE, but in 2020, the exports of knitted apparels dropped by 20.8% to US$ 891.05 million over the previous year. Exports of woven apparel to the UAE were down by 14.7% to US$ 626.02 million.

Exports to UK were down 25.5%

UK is now the fourth largest market for Indian T&C goods, accounting for 5% of India's total T&C exports. Exports to the fell 25.5% to US$ 1603.41 million in 2020. India mainly exports finished apparel to the UK market. In 2020, apparel exports at US$ 1127.95 million were 29.4% lower than in 2019.

Exports to China remained stable in 2020

China accounts for a share of 4 % of India's total T&C exports. Exports to China fell 5.9% to US$ 1319.56 million in 2020. Cotton is the major commodity exported to China. India's cotton exports to China at US$ 1014.83 million, witnessed an insignificant drop of 0.2%.

Cotton fibre most exported commodity to Vietnam

Vietnam is the second country in the top 20 that has perceived a positive growth. Exports to Vietnam rose by 18.2% to US$ 402.53 million in 2020. Here too, India supplies more of cotton fibre. India's cotton exports to Vietnam totalled to US$ 335.86 million, up 45.4% in 2020 over the previous year.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.