No TUFS Subsidies To Mills During Black-out Period (June 28, 2010-April 27, 2011)

The government has rejected claims of textile mills that had sought subsidy against investments made under the Technology Upgradation Fund Scheme (TUFS) during the so-called black-out period, a senior official said. The subsidy claims are to the tune of R1,000-1,200 crore, according to an industry estimate. The blackout period (from June 28, 2010, to April 27, 2011) refers to the time when the government had stopped fresh sanctions of projects under TUFS, seeking to change the contours of TUFS from an open-ended scheme to a closed-ended one, and launched the revised scheme only from April 2011.

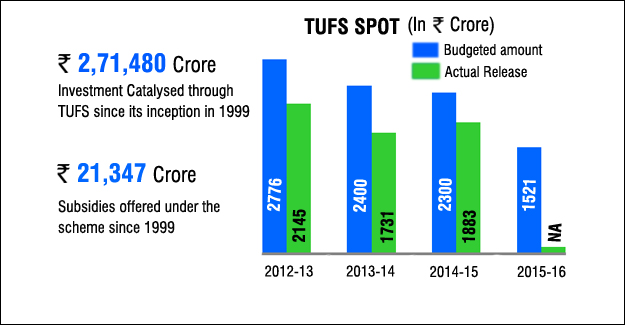

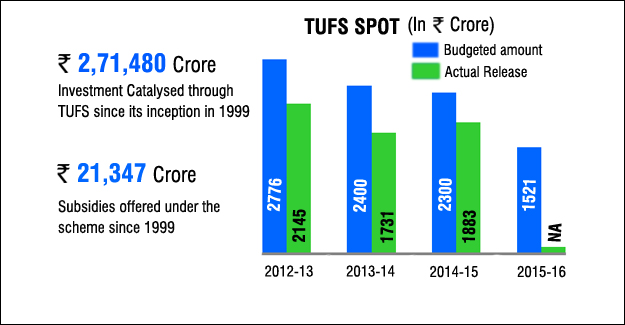

The allocation of a total of Rs 17,822 crore approved by the Cabinet Committee on Economic Affairs (CCEA) last week for subsidy payments under both the old and the new schemes also didn’t make any provision for such claims, the official added.

The CCEA last week decided to introduce the Amended Technology Upgradation Fund Scheme (ATUFS) and approved Rs 12,671 crore for its “committed liabilities” under the old scheme. It provided another Rs 5,151 crore for subsidy payment under the new scheme (ATUFS) over a period of seven years, much less than the allocation seen in recent years.

According to industry executives, in 2010, the textile commissioner sent a letter to banks, asking them not to make any fresh sanction of projects under the scheme. The next year, the government introduced the revised scheme, which took effect only prospectively, leaving the fate of the mills that had made investments during the interim period undecided. The textile industry argues that the scheme can’t be halted midway through a letter from the textile commissioner to banks, as a formal notification informing the government’s decision was not put out in the public domain. The industry’s argument is despite the fact that the government has been extending the TUFS way beyond the initial 5-year period.

Under the old scheme, the government used to provide interest subsidy up to 6%, capital subsidy up to 30% in the form of a grant and support under the margin money scheme (another form of capital subsidy) for investments under TUFS, depending on the segment in which investments have been made.

Under ATUFS, there will be two broad categories: Apparel, garment and technical textiles segments will be provided 15% subsidy on capital investment, subject to a ceiling of Rs 30 crore over a period of five years; the remaining sub-sectors would be eligible for capital subsidy at a rate of 10%, subject to a ceiling of Rs 20 crore on similar lines.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.